News

CGE Energy Inc. – Shareholder Frequently Asked Questions

Posted on in NewsCGE Energy Inc. – Shareholder Frequently Asked Questions

Q. Where does Aradatum intend to install its first system?

A. CGE’s subsidiary, Aradatum, Inc. (“Aradatum”), has been exploring several different locations to use as the site for its first telecom-anchored microgrid system (the “System”). Potential sites, with interested parties, literally are spread from Alaska to Maine. The site actually chosen will depend on a number of factors, including, but not limited to: the timing of the first installation; the local/State incentives being offered to install at that location; and the requirements of potential tenants (network operators/wireless access service providers/etc.).

Q. When does Aradatum intend to install its first system?

A. Depending on the availability of additional capital to complete engineering and manufacturing for commercialization, Aradatum plans to install its first System in early 2024. Aradatum is working to accelerate installation timing, but this schedule is constrained by existing capital limitations.

Q. Has CGE received or applied for grant funding from the government?

A. CGE’s subsidiary, Clean Green Energy, Inc., has previously received grant funding from the government for renewable energy-related projects. Aradatum, Inc. currently is in the process of developing for commercialization its telecom-anchored microgrid system. Given that this system has not yet been tested commercially, and based on the advise of its grant consultant, Aradatum has not yet applied for government grants.

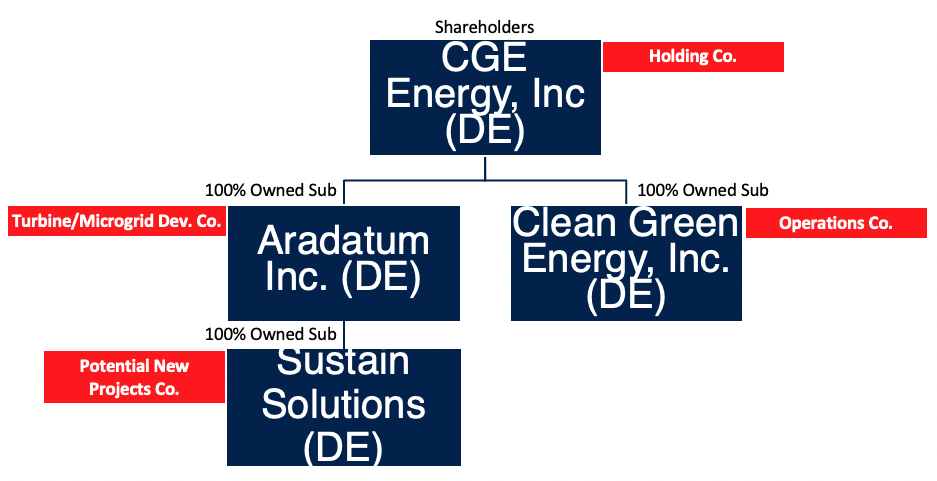

Q. What is the relationship between CGE; Clean Green Energy, Inc.; and Aradatum?

A. CGE currently owns and controls Clean Green Energy, Inc. and Aradatum, which are CGE’s wholly-owned subsidiaries. For a visual representation of the current corporate structure, see below:

Q. What are CGE’s plans for enhancing shareholder value?

A. CGE’s management and directors include the largest shareholders of CGE, collectively holding (directly or indirectly) over 80% of the total issued CGE common shares, so enhancing shareholder long-term value will continue to be a primary goal. CGE’s preference for enhancing shareholder value continues to be a future spin-off of its Aradatum subsidiary. Aradatum’s stock structure has been implemented to continue to allow for CGE shareholders to receive one share of Aradatum common stock for each share of CGE held at the time of such a spin-off. However, as Aradatum raises capital directly and its requirements and ownership structure change accordingly, Aradatum may adopt a different structure or going-forward plan that varies from CGE’s current preferences.

Q. What is the planned spin-off timing?

A. To the extent that CGE proceeds with a spin-off, the timing of any spin-off or other liquidity event will depend on a number of factors, including, but not limited to: the timing of Aradatum’s commercial installations; the success of third-party testing at those installations; Aradatum’s projections on growth and valuation; and general market and regulatory conditions.

Q. What happened recently to the share price for CGE?

A. CGE does not comment publicly regarding the value of its common shares, and it is up to each shareholder to determine whether to buy or to sell and, if so, at what price. On October 11, 2022, CGE issued a press release stating that it had ceased to support the OTC Pink market as of the prior year. CGE had made the determination not to continue to pay for a listing on the OTC Pink market, as CGE did not believe that the quotations provided by brokers in that market accurately reflected CGE’s actual value, and CGE was concerned that its reported share price was being manipulated by small volume transactions. On February 22, 2023, CGE reported that, as a result of it no longer supporting an OTC Pink listing, trading in CGE Shares apparently was moved to the OTC “Expert Market”. CGE does not support this “Expert Market” either, and CGE believes that low-volume trading may continue to be used to manipulate share pricing. For example, on February 22, 2023, the last published sale price of CGE common shares trading under the CGEI symbol was $.0004, reflecting a sale of 690 shares at that price. Assuming that this reported transaction was correct, it appears to have involved the purchase/sale of CGE shares for a payment of only $0.27 (690 shares x $.0004/share). Especially considering the cost and fees commonly involved in buying and selling securities, CGE believes that this kind of trading confirms that market manipulation based on low-volume transactions may be occurring.

Q. Is the symbol tradable or frozen?

A. CGE has not received any information suggesting that shares trading under the CGEI symbol have been frozen. According to OTC Markets, CGEI-traded stock on its platform is “eligible for Unsolicited Quotes Only” and “reflect unsolicited customer orders.” In addition, OTC Markets states that “[t]he Expert Market® serves broker-dealer pricing and investor best execution needs. Quotations in Expert Market securities are restricted from public viewing.” Please contact OTC Markets directly (

Q. Why might my Fidelity/TD Ameritrade shares not show up on CGE’s records?

A. The SEC adopted certain rules in the mid-1980s that govern when an issuer, such as CGE, may obtain a list of its “street name” shareholders who have not objected to such disclosure. “Street name” shareholders are those shareholders who hold their shares through a broker or bank custodian, such as Fidelity or TD Ameritrade. Under this form of ownership, shares are “owned” by the broker, bank or other intermediary, so that only the broker or bank knows the identity of its client, the true beneficial holder. If you hold shares beneficially through your broker or bank, we can only obtain your information if your broker or bank provides it to us. Please contact your bank or broker for more information.

Q. Is there anything I need to do to maintain my status as a shareholder of record?

A. Please ensure that your broker or other intermediary has your up-to-date contact information on file. This will help ensure that you receive any notices or other important documents related to CGE.

Q. How do I remove a restriction on my shares?

A. To attempt to have a share restriction released, please contact CGE’s Stock Transfer Agent, Signature Stock Transfer. Jason Bogutski at (972) 612-4120 and he will walk you through the process. Generally, the process involves providing stock ownership information, a formal request that you would like the restriction released, and sending the original paper stock certificates to Signature Stock Transfer. You may be asked to provide additional documents or information. If the legal requirements of lifting a restriction are met, and once the fee is paid and the paperwork is processed, a new certificate of ownership without the restriction in place will be issued.

This page may contain “forward-looking statements” that are within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by certain words or phrases such as “may”, “will”, “aim”, “will likely result”, “believe”, “expect”, “will continue”, “anticipate”, “estimate”, “intend”, “plan”, “contemplate”, “seek to”, “future”, “objective”, “goal”, “project”, “should”, “will pursue” and similar expressions or variations of such expressions. These forward-looking statements reflect the Company’s current expectations about its future plans and performance. All forward-looking statements included on this page are based on information available to us on the date hereof and speak only as of the date hereof. We undertake no obligation to update or revise publicly any forward-looking statements. Actual results may differ materially from those projected in the forward-looking statements.