Increasing Stock Transparency

What Happened

It is the management’s fiduciary duty to the stockholders of CGE Energy, Inc to make known the manipulation activities of the CGEI stock that caused the devaluation of the market cap by $56M. We formally submitted a complaint to OTC Markets on October 7th, as well as FINRA and SEC on December 7th. No legal costs have been accrued in submitting these complaints.

Below is the background on the company’s merger, and specifically on the market maker actions against our stock.

To recap, CGE Energy performed a reverse merger with McKenzie Bay International (then ticker MKBYD), and a 1-for-25 reverse spit took effect on 9/14/15. MKBY’s outstanding shares went from 300-million shares to 12-million, CGE Energy’s 1-million units became 50-million, for a total of 62,000,000 outstanding shares. Collectively, there is substantial stock support and restricted shares that leave a 2.6-million share float.

On the date of the 9/14 reverse, the stock price closed at $1.78 and hit its peak on 9/15 at $1.90. After that date, the market maker Knight Capital Securities has been taking unique actions against the movement of the stock. Many stockholders contacted us, as they were livid that they are purchasing at the ask, and that Knight is processing below ask. This has consistently lowering the stock value since the reverse. Because this was done in small amounts (for example, purchased at $1.80 and fulfilled at $1.73) it was diagnosed as irregularities and price improvement.

But after numerous phone calls from our shareholders since, our own level 2 monitoring of the activity, and the discussion of these irregularities with our legal council we have realized that foul play is indeed taking place. We are seeing manipulation of the stock on behalf of Knight. If one looks into Knight’s history in the market, they have been in trouble for this multiple times before, and their “trading glitches” have caused much market disruption.

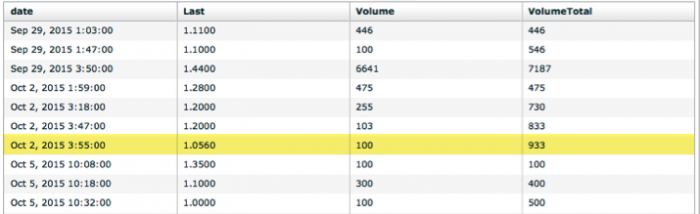

Knight’s most substantial action was Friday, October 2nd. It involved a trade at 3:55pm that was purchased at the ask price of $1.28, processed at $1.056, and posted at $0.116. This move caused much grief at the time of the incident, and by having it posted in the trade history causes an appearance of stock volatility that is not accurate. Despite the growth of the company, and support before and after the merger, Knight is taking unlawful moves against us, and this is why this manipulation needs to be made known.

Manipulation Example

By looking at the OTC 5-day charts, the 3:55pm trade on October 2 is listed as $1.056.

But if you look at the Stock Quote page shows the Oct. 2nd’s close (Seen here in “Previous Close”) at $0.116.

What We are Doing

To combat this activity, we are currently undergoing two years of certified audited financials required to qualify for full-reporting status, and the company’s planned up-list to the OTCQB Marketplace. The OTCQB is considered by the SEC as an “established public market” for the purpose of determining the public market price when registering securities for resale with the SEC. OTC Pink, our current exchange, is not considered as such, and some broker dealers may not trade or recommend OTC Pink stocks. Because the OTCQB dramatically increases transparency, reporting standards, management certification, and compliance requirements, the majority of broker dealers trade stocks on the OTCQB. Historically, this has resulted in greater liquidity and awareness for companies that reach the OTCQB tier.

This decision represents our continued commitment to our shareholders, and management believes that trading on the OTCQB will enhance CGEI liquidity, transparency, broaden our shareholder base, and continue to increase market adoption of our integrated energy solutions business model.